Scaling tech company with a catalyst

My first English text on Substack is an introduction to one of my top 3 holdings

Today’s investment thesis is not entirely unknown, as I briefly mentioned the company in a Finnish Traders' Club episode in September 2022. The story of this long-term pick has since matured, and I believe it deserves a deeper dive into the reasons behind the investment thesis, as I believe the company has a good chance of doubling over the next five years (CAGR 15%).

Red Violet ($RDVT) is a small American technology company that was originally part of a publicly traded company called Fluent. In 2018, it became its own listed company through a spin-off.

Red Violet’s business model is straightforward:

Acquire a vast amount of data on individuals and businesses from various sources.

Create a scalable platform for processing and productizing it.

Sell analytics to different customer segments.

All the data is collected into a massive CORE database, which serves as the heart for two key products, IDI and FOREWARN. Interactive Data Intelligence (IDI) is an analytics solution that provides organizations with tools for identity verification, fraud prevention, and regulatory compliance. Its flagship product, idiCORE, supports risk management and corporate background research activities. FOREWARN is an application specifically tailored for real estate professionals, helping realtors identify and mitigate risks during client interactions. Both are sold to customers based on licensing, with fees varying by service usage and monthly billing.

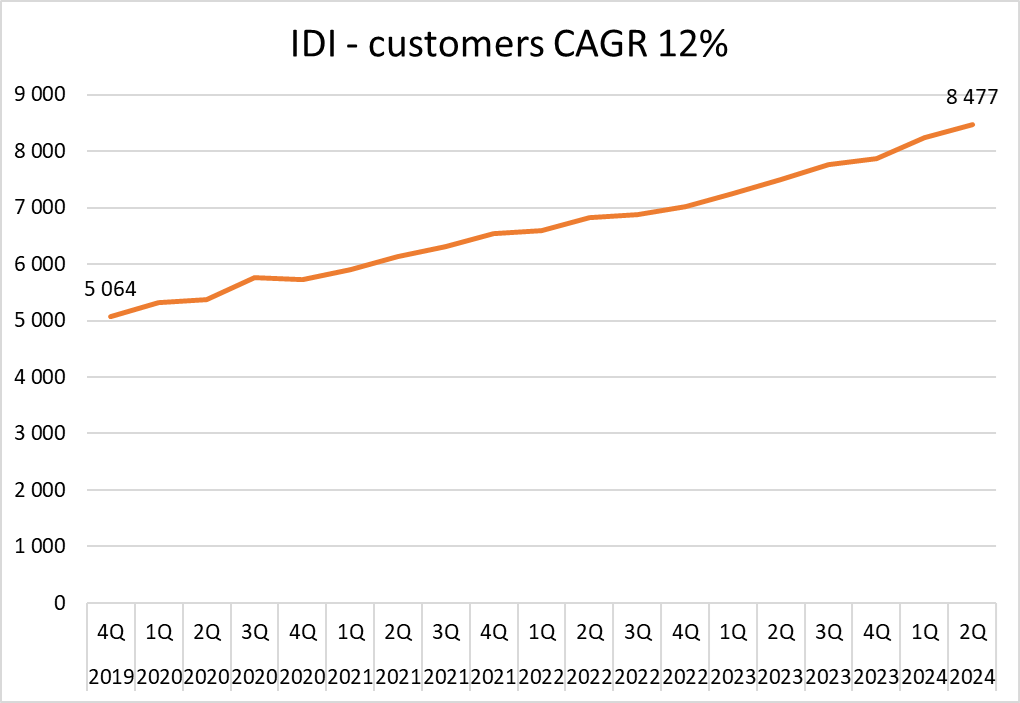

In the latest 2Q24 earnings report, FOREWARN had 263,876 users and IDI had 8,477 billable customers. Growth in both products has been steady. Although in some M&A cases their customers have switched to competitors' products due to synergies, they have later returned to Red Violet’s better service, showing anecdotally the company's relative competitive advantage.

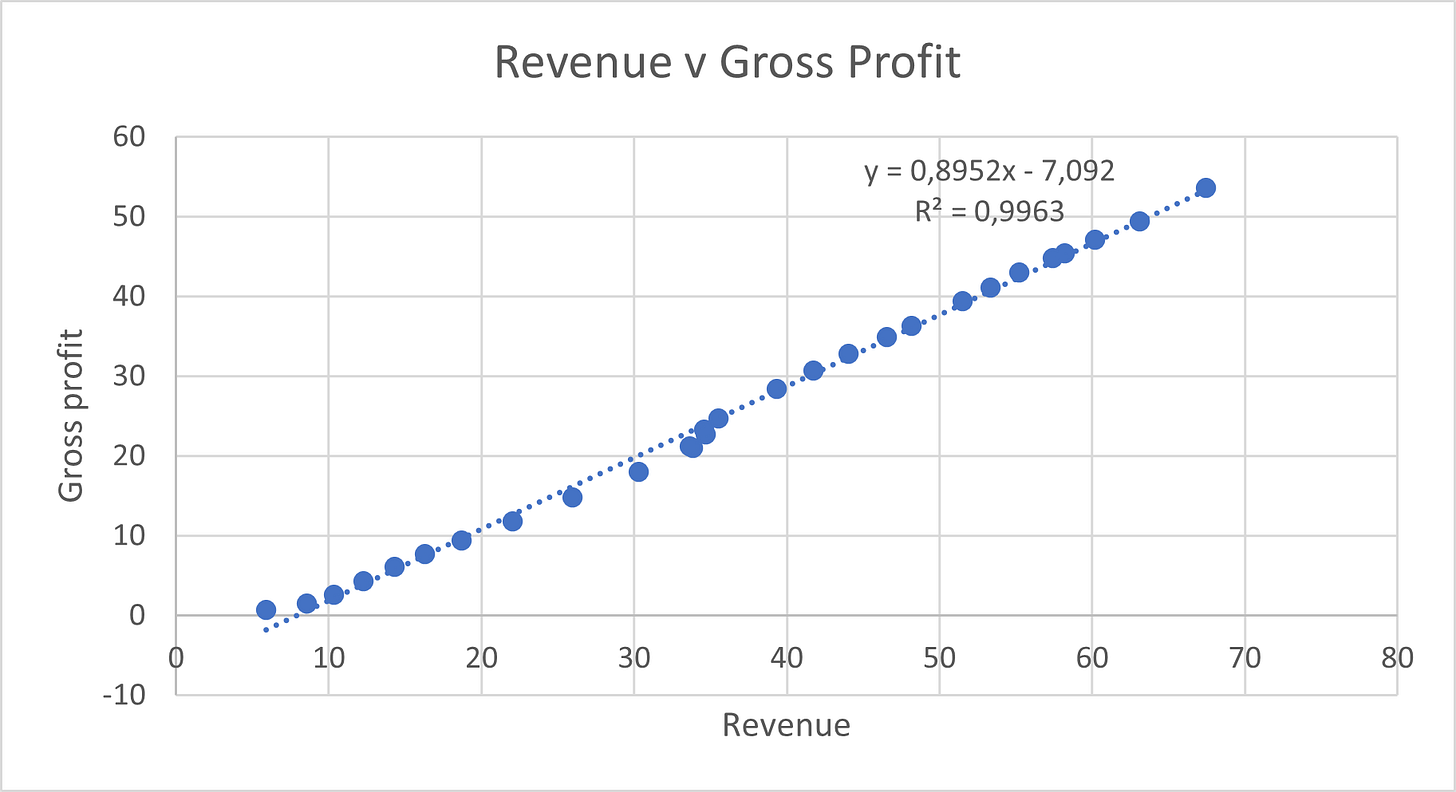

In its business model, there are significant fixed initial investments, particularly related to the construction of databases and systems. As these investments are mostly behind Red Violet, the company’s real profitability will emerge as revenue grows.

A simple regression analysis shows how additional revenue (in MUSD) translates to a gross margin of about 90%, which CEO Derek Dubner has also confirmed in recent calls.

As a result, growth translates into an ever-improving gross margin, which has already risen from 50% to 80%, with the increase still continuing.

We can continue to illustrate scalability by walking down the income statement. For example, here are operational expenses (OPEX) per FOREWARN user.

When you relate the increased number of FOREWARN users to increased business expenses, the average new user has cost $78 in annual business expenses, while the user brings in more than $20 in monthly revenue at a 90% gross margin. At the same time, customer retention ("gross revenue retention") has consistently been over 90%, with the latest result being 94%.

Over the past year, the company has added 117,000 FOREWARN users and spent about $18 million USD on sales and marketing, yielding a conservatively estimated customer acquisition cost of $150 (although, not all sales and marketing expenses go directly toward customer acquisition).

Using the presented figures, the formula creates a simplified economic model for added customers with excellent characteristics:

Customer acquisition in year 0: $150

Revenue in year 1: 12 * $20 = $240

Gross margin in year 1: $240 * 90% = $216

Operating profit in year 1: $216 - $78 = $138

Revenue in year 2: $240 * 90% = $216

and so on.

This approach to valuing the business is a nice addition for me, but it is not the basis on which I make my own valuation. More on this later.

PRE-MORTEM

If Red Violet doesn’t continue to grow, it won’t be a good investment. Based on my assumptions, annual revenue growth should exceed 20% for the next 3-5 years. Red Violet’s $6 million in operating profit over the past 12 months doesn’t support its current valuation unless there is a promise of better results.

The business model also heavily relies on scalability, meaning that added revenues should turn into operating profit with an incremental margin clearly north of over 25%. This would be a significant step down from the current incremental margin, where over 40% of additional revenue turns into operating profit. For example, from 2019 to mid-2024, revenue grew by +$37 million, and operating profit by +$17 million; thereby incremental operating profit margin was 46%. Although Red Violet's acquired databases are under multi-year contracts, their prices could see an increase, or the management, blinded by growth prospects, could completely lose cost control.

Many companies make important decisions about individuals and other businesses based on Red Violet's analyses, so the results must be accurate. If the products inadvertently lead to negative situations, lawsuits could follow and become costly. This would also deteriorate the credibility of the products, which rely on customer trust. Such concerns were raised for example in this recent article.

FOREWARN product, used by real estate agents, has 200,000 users. According to management statements, there are 1.5 million real estate agents in the U.S., of which 900,000 are active. Thus, Red Violet’s current market share in this segment is already over 20%. Growth in this key segment has the potential to quadruple, after which the company will need to succeed in finding other successful verticals. The company's recent announcement of a new IDI customer is a step in the right direction.

Customer retention must also remain high. Otherwise the previously identified attractive financial model will break and the company will fail to create additional value.

WHY OTHERS (MAYBE) DON’T GET IT

Before every investment decision, I try to understand why other investors might be willing to sell their shares to me at a price I find attractive. If I don’t understand this even on a superficial level, I’m likely buying at a too steep of a price.

Firstly, the most obvious reason: Red Violet has very little analyst coverage. In the U.S., a company with a market cap under $500 million is tiny, and there’s rarely an analyst on the earnings calls to ask questions. When searching for the company here on Substack, results yield “There are no posts about RDVT“. My broker Nordnet shows only 62 owners for the company on their platform. Few people simply know - even fewer care - about Red Violet.

Secondly, the company doesn't perform well in stock screening, as its scalable model has just started to break through on the income statement. Investors needs to make their own adjustments to normalize the actual earnings power and this is simply too demanding of an exercise for so many. Rolling 12-month operating profit just recently turned positive in 2Q2022. Current (unadjusted) valuation of EV/EBIT 60, based on enterprise value (EV) and operating profit (EBIT), doesn’t exactly excite me.

Thirdly, company’s growth has not been smooth, and reaching the current situation has required long-term effort. Annual changes in revenue have varied wildly between +14% (2020) and +90% (2018) since the IPO. The important groundwork is now presumably paying off, and investor looking at the recent history may not get a right picture of the future.

Finally, and what I consider the most important non-obvious element, is how the contracts won by the company convert into the income statement.

Historically, Red Violet has disclosed the sizes of new FOREWARN contracts made with different real estate associations. A typical such release includes both the real estate association and the number of realtors within it, which you can compile as a time series from the company's announcements.

Let’s build on this data and visualize it cumulative by comparing that series to actuals.

Although FOREWARN is mainly sold through large contracts, the company has stated that in individual cases, it charges a fixed fee of $20 per month. From the time a contract is made, it often takes months for the real estate association to implement the new service. After that, the realtors are trained to use the service, and only then does "everyday use" begin, with varying rollouts.

In other words, it can take several quarters for a new contract to turn into revenue recognition on the income statement. Thus, it can take up to a year for published contracts to translate into actual users. Let’s repeat the earlier chart by pushing the cumulative user count collected from the announcements forward by 12 months.

Now we can see that the data series match quite well, meaning that the number of announcements corresponds to future user counts with a one-year delay. If we believe in this pattern, earlier customer announcements predict significant growth for the remaining quarters of the year. In the latest earnings call, CEO Derek Dubner said, “We remain committed to maintaining this accelerated rate of growth,” referring to the previous quarter’s 30% annual revenue growth.

The comparison suggests a leap in growth, which would more than double FOREWARN users in one quarter. This is something I don’t fully believe will happen. However, this strengthens my belief in accelerating growth and the rationale behind it.

Recognized revenue eventually depends on both fixed contract price and usage-based billing, which are difficult to estimate accurately from the outside. Still, let’s continue with rough estimates and make a simple simulation of revenues based on the following assumptions:

FOREWARN revenue: $30 per user per month

IDI revenue: $300 per customer per month

For each quarter, we apply the user and customer count from the same quarter a year ago due to the previously observed delay between customer announcement and actual number of customers.

Since the model uses the number of users from a year ago, it also provides an estimate for the upcoming quarters. If one would believe these numbers, latest +30% revenue growth in 2Q24 would accelerate further in the coming quarters, growing by +30-60% compared to the previous year, much faster than the earlier trend.

VALUATION

I like the approach of “long introduction – short valuation.” For the reasons mentioned in this analysis, I believe Red Violet has a high probability of achieving the following:

20% annual revenue growth for the next five years

40% operating profit margin on incremental revenue

EV/EBIT 15

TTM (Trailing Twelve Months) 2Q2024

Revenue: $67 million USD

Operating profit: $6 million USD

In five years

Revenue: $167 million USD (CAGR 20%)

Operating profit: $46 million USD (CAGR 50%)

EV (Enterprise Value): $690 million USD

At the time of writing, Red Violet’s stock price is $26, with 14 million shares and $31 million in net cash. Thus, EV is $334 million, and the assumptions described above would result in an annual return exceeding 15%.

FINAL THOUGHTS

Finally, it’s worth mentioning that Red Violet is led by a group of serial entrepreneurs who have founded and scaled several previous companies focused on data collection and services built around it (Accurint sold to LexisNexis in 2004, TLO to TransUnion in 2009). Each company has been an improved iteration from previous experiences, and this time the new element compared to earlier ventures is a scalable cloud-native service model. Their prior expertise adds credibility to their approach, and the current leadership team has worked together for over 25 years.

In addition to their entrepreneurial background, management has a track record of consistent capital allocation. For example, during the small-cap frenzy in November 2021, Red Violet raised an additional $21 million in growth capital when the stock was trading at above P/S 11 and around $38. The market cap was over $500 million at that time. When the stock price halved within just two years, management began buying back shares at below P/S 5, below $20. However, the total share buyback was only $5 million, just a few percent of total market cap. Still, it was a symbolically important message that would please the fans of the book "The Outsiders".

Red Violet is currently one of the top 3 holdings in my portfolio, with a weight of over 15% and an average price of $19.7 (please note that I may change my mind at a moment’s notice without any separate update or duty to do so to anyone - do your own research). I expect the Q3 earnings to further confirm the accelerating 30%+ annual revenue growth and improved profitability. This would also make Red Violet more "screenable", bringing it into the radar of many investors.

Or maybe it won’t.

Thank you for reading!

If you enjoyed this or learned something new, you may also want to follow me on X, formerly Twitter. Also consider following the writings of amazing micro cap contributors such as

and . My Finnish followers may also want to check out “Tähtäimessä osakkeet” book and online course.

Red Violet out with strong 1Q25.

Revenue growth +26% over thesis assumptions (>20%), the same for 50% incremental EBIT margin of revenues (>40%). Lucky with the strength of verticals, however. Stock at all time highs, over 2021 small-cap bubble peak.